After the buyer and seller agree on a price and get under contract doesn’t mean it’s a done deal—mortgage lender has to approve, too. After all, it’s the lender’s real estate investment as well. To get a mortgage, you’ll need a home appraisal because the home serves as collateral for your lender. If for some reason you end up unable to make your mortgage payments, the lender will have to foreclose on your home, then sell the property to recoup its costs. So your mortgage lender will have to agree on the value of your home before approving your mortgage.

Who orders an appraisal?

The mortgage company actually orders the appraisal from an independent appraisal company. This company is not affiliated with the mortgage company, and the buyer actually pays for it to be done as part of the costs of acquiring a mortgage.

What happens at an appraisal?

An appraiser will go through the home and evaluate the condition, number of rooms, bedrooms and bathrooms. They will also independently measure the square footage of the home, but only the square footage Above Grade. That means, any finished square footage in the basement, or any part of the house that is partially under ground, probably won't count toward the Above Ground square footage number, no matter what the listing agent marketed it as, or the square footage in public records. This is used to calculate the average price per square footage value. The price/sqft is another comparison value used to evaluate the home, along with location, market conditions (like multiple bids over asking) and updates in the home, as compared to other homes in the area that sold recently.

After the appraisal (usually 15-20 minutes), the appraiser goes back to his office to look at market data online and picks the best 6 comparable properties to refer to. Out of those properties, he chooses the best 3 that are most like that property, closed recently (last 6 months), are located within a mile of the home or in the same neighborhood, HOA, or township, depending how close the homes are in this location.

If the mortgage is an FHA or VA loan, the appraiser may also note any safety repairs needed to satisfy these particular mortgage qualifications.

What happens if the home doesn't appraise for the agreed-upon contract price?

After the appraiser comes up with his value, he sends it to the mortgage company underwriters who also look over the data and have to agree with his assessment as well. The underwriters usually agree, and may note any questions or clarifications needed on safety repairs. At that point the appraisal is sent to the buyer and their agent. If it comes in at exact value of the offer or higher, the seller usually doesn't get to see it, unless the buyer agrees. If it does not appraise for the contract price, the buyer needs to send it to the seller and one of the following can happen:

- Buyer can ask Seller to lower price to the appraisal price (not usually done in Seller's markets);

- Buyer can bring cash to closing that covers the Gap between the offer price and appraisal price;

- The agents can help the Buyer challenge the appraisal, if there was some objective error (such as number of beds, square footage calculation, or missing a comparative property.) Just like a referee call in a game, this challenge is rarely overturned due to subjective opinion differences.

- Finally, if none of the resolutions above work, the buyer can leave the transaction, and terminate. They will get back their deposit if they had an "Appraisal Contingency" or the price difference means they cannot obtain a mortgage (the Mortgage Contingency.)

How much do Appraisals Cost?

Appraisals are running the range of $450-$695 right now due to the high demand. They can take 2+ weeks to complete so if a 30-day close, it's important for the mortgage company to order the appraisal right away.

Why are appraisals important?

Appraisals are there so that the mortgage company can properly assess the collateral they are loaning the money for. If the collateral isn't going to sell at the same price today if the buyer defaults on their loan, the bank could lose money. The appraisal also protects the buyer for unknowingly paying more for a property than it's worth. In a seller's market, however, many buyers will pay a little more in order to get into the house of their dreams.

And know this...history has shown that real estate prices do rise over time, so as long as the buyer doesn't want to sell in the next 3-5 years, odds are that that appraised value of the house will increase.

It's always good to talk over the possible appraisal strategies with your realtor before you put an offer on a home, should it not appraise. If you are the seller, it's important to consider which offers coming in address this upfront, otherwise there could be surprises after the appraisal. Regardless of the outcome, your real estate professional can guide you through all the scenarios so you are prepared for the appraisal time, whatever the value may be.

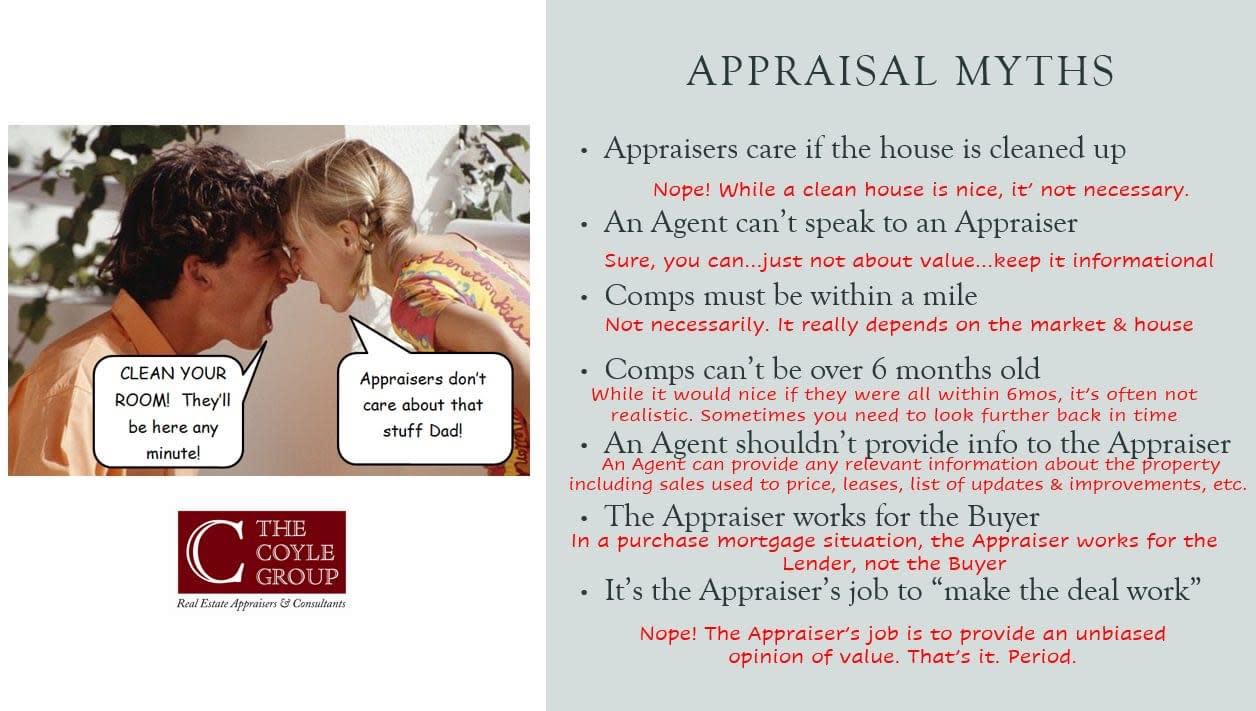

((Photo below courtesy of Michael Coyle, of The Coyle Group Appraisers)